How To Make Money During A Trade War

President Trump's plans for tariffs on about $threescore billion of Chinese imports have rattled equity markets. Investors should begin to study which types of industries, countries and companies could win or lose if an all-out trade war erupts.

Since his election campaign, President Trump has promised voters to accept tough action confronting China to protect United states of america manufacture. While we don't take a political stand on the decision, we, as equity investors, must appraise the potential touch on of what may become a defining policy move of the administration.

Tactical Posturing or War Footing?

Nobody knows exactly how things will unfold. The tariffs appear today might be a shrewd tactical move aimed at squeezing concessions out of Communist china. Some measures could be temporary. And Prc might bow to the pressure and be more accommodative to US demands than expected.

But what if things get out of command? If the United states decides to push Cathay difficult and China retaliates with equal force, the impact would be widespread. On a macroeconomic level, this scenario would probably trigger a slowdown of economical growth in both the US and China. Only for companies and stocks, the effects would be much trickier to predict.

Shifting Trade Relationships

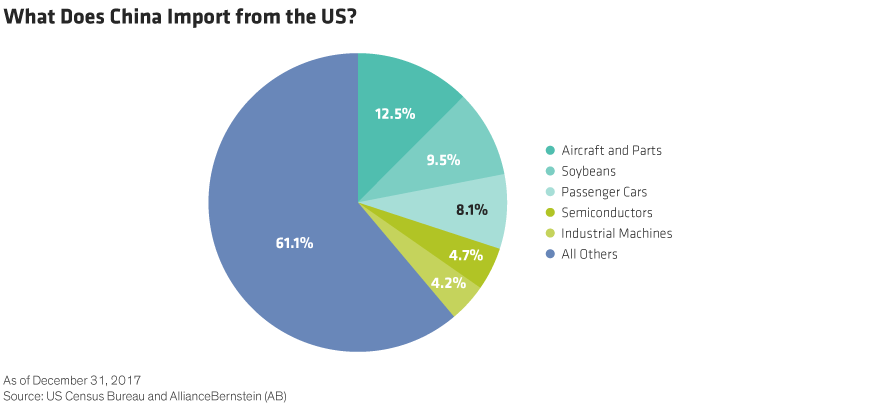

New merchandise barriers could spur a shift in traditional trading relationships. China would be probable to rethink its trade alliances in the region and get closer to partners in Southeast Asia, Latin America and the European Wedlock (EU). In particular, Communist china would seek new sources for products that it currently imports heavily from the United states of america. Examples include aircraft and parts; pork, which is in plentiful supply across parts of Latin America and Asia; and soybeans (Display).

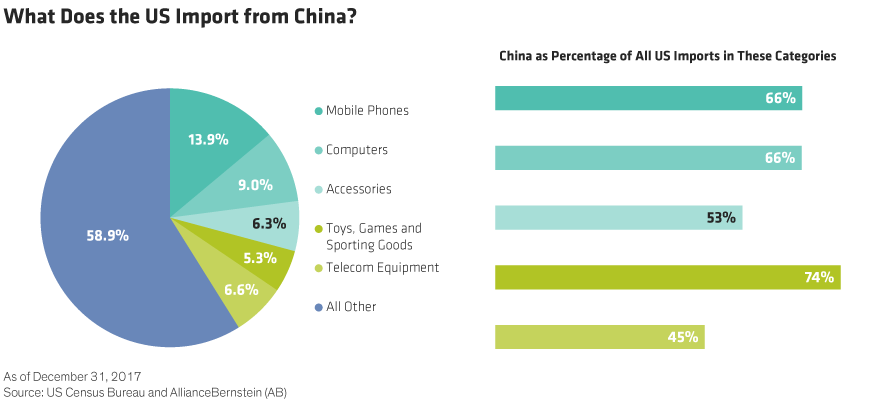

The US imports a wide multifariousness of products from Mainland china (Display). A dramatic shift in the trading relationship would take the potential to redraw the supply chains that have become the backbone of the global technology industry—and vital for US manufacturers. For case, consider Apple tree's manufacturing of the iPhone in China. Many components are produced in China past S Korean and Taiwanese companies, which could transport their operations elsewhere in the region.

Three Guidelines for Investors

So, what should investors do today? While uncertainty abounds, three important guidelines can assistance investors navigate a potential trade war scenario.

-

1. Identify the most vulnerable products, industries and companies

Companies with big and complex supply chains in China, especially those in the electronics and telecom industries, will probably get hit in unpredictable means. Investors need to begin assessing which companies will adjust smoothly to a new reality and which may feel significant disruption to their operations.

Chinese products that compete directly with products that take a US manufacturing base could also be vulnerable. Big categories here include sports equipment and piece of furniture, the latter specially potent in North Carolina. In addition, US-based clothes companies could advance a shift of manufacturing away from China toward countries like Vietnam and Indonesia.

United states products with political significance could also be targeted. The EU has already threatened to striking the US with tariffs on emblematic The states products such as Levi jeans and bourbon if Trump raises trade barriers to European steel imports to the U.s.a..

-

2. Find companies that could actually benefit from merchandise state of war fallout

Shipping parts are a big component of the US–China merchandise relationship. If China decides to boycott Boeing, this could exist a boon for Airbus. If China can no longer buy soybeans from Illinois or Iowa, it may await to Brazilian producers instead. Red china may also turn to European companies to purchase various types of capital equipment and precision machineries that it currently buys from United states groups.

Communist china may as well deny licenses to US firms. This would reduce competition for European or Asian companies in a wide range of sectors and industries, giving them a distinct advantage in the world's 2nd-largest economy.

-

iii. Look for specific targeted areas in which ane country may have leverage over another

China is a world leader in the supply of rare earth and specialty metals that are used as raw materials in a wide variety of products ranging from batteries to high-precision electronic equipment. These include dysprosium, neodymium and molybdenum. If People's republic of china decides to withhold the supply of rare globe and specialty metals, and prices ascent, companies that rely on these materials for their products could become striking. On the other paw, companies that produce these metals could benefit.

When it comes to innovation, the United states has leverage over Communist china. The Usa is already trying to deny Chinese companies admission to United states engineering firms, as seen in President Trump's decision to block a takeover of Qualcomm by Broadcom of China before this calendar month.

Prepare for All Possibilities

The potential implications of an all-out trade war between the The states and People's republic of china would exist vast. Investing in this surroundings volition crave an in-depth fundamental appreciation of the complex moving ridge of effects that would unfold over time.

While information technology is by no means certain that today'south news will lead to that outcome, the risks have clearly risen. Investors need to start preparing now for all possibilities. Many potential beneficiaries of the shifting trade landscape won't be discovered immediately by investors, so those who find them early on could generate strong returns as the market catches up.

The views expressed herein do not constitute enquiry, investment advice or merchandise recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Source: https://www.alliancebernstein.com/library/Can-Investors-Make-Money-in-a-US-China-Trade-War.htm

Posted by: tayloraboold.blogspot.com

0 Response to "How To Make Money During A Trade War"

Post a Comment